Delhi Pollution Control Centers Shut Amid Protest Over Fee Hike.

Delhi’s Pollution Under Control Centres (PUCC) were shuttered today as petrol dealers staged a protest against the Delhi government’s proposed increase in pollution certificate charges. The unexpected closure of these essential centers has sparked concerns about the impact on vehicle owners and the broader implications for the city’s air quality management.

The move to shut down PUCCs follows the Delhi government’s recent proposal to raise the fees for pollution certificates, a key document required for vehicles to comply with emission standards. Petrol dealers argue that the hike, which could significantly increase the cost for vehicle owners, is both unfair and burdensome.

“This sudden fee hike is an additional financial strain on vehicle owners, many of whom are already struggling with the cost of maintaining their vehicles,” said Rajesh Kumar, a representative of the Delhi Petrol Dealers Association. “We have decided to close the PUCCs to protest this decision and to urge the government to reconsider.”

The Delhi government’s proposal aims to cover the increased operational costs of the PUCCs and enhance the enforcement of pollution control measures. However, critics argue that the fee increase disproportionately affects low and middle-income vehicle owners, who may find it difficult to absorb the additional cost.

In response to the PUCC closures, Delhi’s transport department has advised vehicle owners to check their pollution control status through online portals or wait until the centers reopen. The department has also promised to review the fee structure and engage in discussions with stakeholders to address concerns.

“We are aware of the inconvenience caused by the closure of PUCCs and are actively working to resolve the issue,” said a spokesperson from the Delhi Transport Department. “Our goal is to ensure that pollution control measures are effective while also being fair to the citizens.

More Read

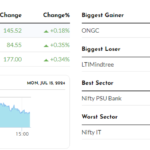

As the markets continue to navigate a complex global and domestic environment, the focus will be on corporate earnings, macroeconomic data, and policy developments. Investors will be keenly watching for cues that could provide direction for the markets in the near term.

Overall, the sustained rally in Indian benchmark indices reflects a positive investor sentiment, driven by strong fundamentals and supportive global cues. As the Nifty nears the 24,600 mark and the Sensex continues its upward trajectory, the markets are poised for an interesting journey ahead.